霸刀分享- 2025年有色金属行业增长的原因

2025年,中国有色金属行业展现出强劲的增长势头,不仅在股市表现亮眼,在实际经营层面也实现了营收与利润的双升。这一轮增长并非单一因素作用的结果,而是宏观政策、市场供需、金融环境和产业转型等多重力量共振的体现。根据多份研报和官方文件,可以从以下几个方面进行深入剖析。

1. 政策强力支持,明确发展路径

2025年9月,工业和信息化部、自然资源部等八部门联合印发《有色金属行业稳增长工作方案(2025-2026年)》,为行业发展注入了强心针。该方案明确了未来两年的发展目标和具体举措。

目标清晰:提出行业增加值年均增长5%左右,十种有色金属产量年均增长1.5%左右,并强调提升铜、铝、锂等国内资源保障和高端产品供给能力。

举措务实:方案聚焦“保资源、优供给、促转型、拓消费、强合作”五个方面,例如通过绿色通道加快矿产项目审批、推动绿色化数字化改造、拓展新能源汽车和AI服务器等新兴领域消费,这些都直接利好行业长期健康发展。

2. 下游需求旺盛,拉动核心金属消费

多个高景气度终端领域的快速发展,对有色金属形成了强大的需求支撑。

新能源与电动汽车:新能源汽车的普及直接拉动了对铜(单车用铜量超80kg)、锂、钴的需求。同时,光伏装机量的增长也带动了锑等金属的消费。

高科技产业:以人工智能(AI)为代表的新质生产力发展,对算力基础设施提出了更高要求。AI服务器是耗铜大户,其大规模建设成为推高铜需求的关键变量。

传统基建复苏:中国的铁路、船舶、汽车等金属密集型行业在2025年初实现两位数增长,表明传统工业需求也在回暖。

3. 宏观与金融环境利好

外部金融环境的变化对以美元计价的有色金属价格有决定性影响。

美联储开启降息周期:市场普遍预期并最终确认美联储将在2025年重启降息。降息降低了持有无息资产(如黄金)的机会成本,同时可能削弱美元信用,这两大因素共同推动了黄金等贵金属价格创下新高,并提振了整个有色金属板块的风险偏好。

避险情绪升温:地缘政治冲突(如俄乌局势)和中美贸易关系的不确定性,增加了市场的避险需求,资金流入黄金等安全资产,进一步推高了价格。

4. 行业财务表现全面爆发

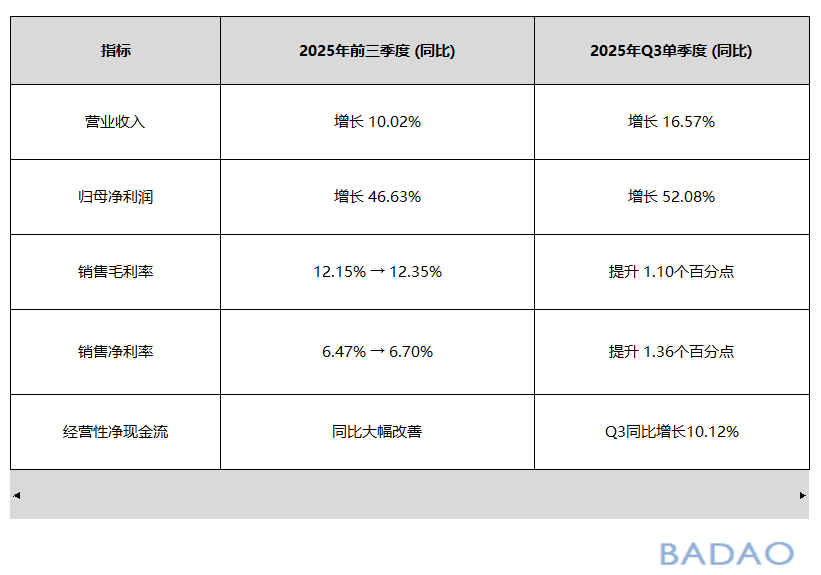

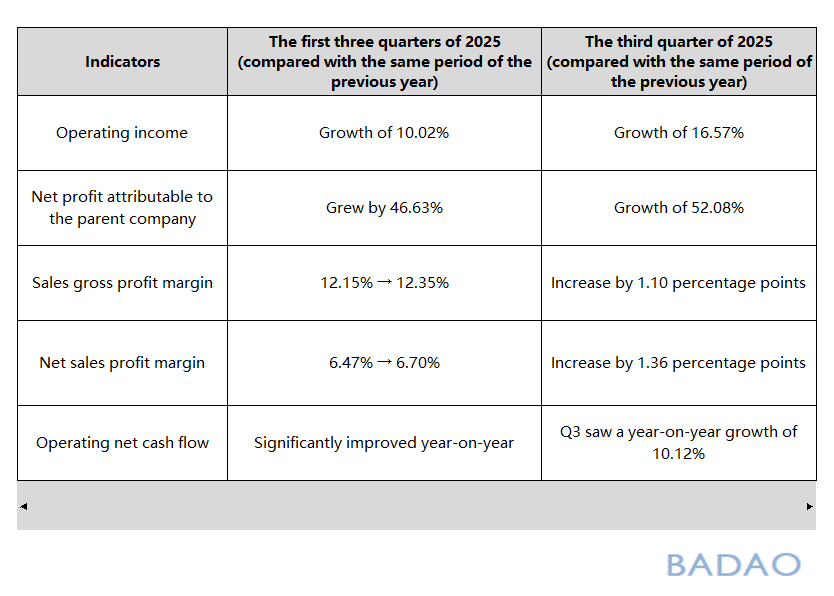

最直观的证据来自上市公司的财报数据,显示行业整体进入了业绩上行周期。 以下表格总结了2025年前三季度A股有色金属行业的关键财务指标:

(补充说明)数据显示,行业不仅在收入端稳步扩张,更在利润端实现了加速增长,反映出盈利能力的显著修复。同时,现金流的持续改善,意味着企业的“造血”功能增强,为未来的投资和扩张提供了坚实基础。

综上所述,2025年有色金属行业的增长是由政策东风、需求复苏、货币宽松三大引擎共同驱动的系统性行情。国家顶层设计的《稳增长工作方案》稳定了市场预期;新能源、AI等新兴产业创造了新增量;而美联储的降息则提供了绝佳的金融环境。这些因素共同作用,使得行业上市公司交出了营收、利润、现金流全面向好的优异答卷,确立了行业向上的确定性趋势。

The reasons for the growth of the non-ferrous metals industry in 2025

In 2025, China's nonferrous metal industry exhibited robust growth momentum, only delivering a remarkable performance in the stock market but also achieving a dual increase in revenue and profits at the operational level. This round of growth was not the result of a single factor rather a reflection of the resonance of multiple forces, including macro policies, market supply and demand, the financial environment, and industry transformation. According to several research reports and official documents, can be analyzed in depth from the following aspects.

1. Strong policy support and clear development path

In September 2025, the Ministry of Industry and Information, the Ministry of Natural Resources, and other eight departments jointly issued the "Work Plan for Stabilizing Growth in the Nonferrous Metal Industry (2025-226)," which injected a strong shot in the arm for industry development. The plan clearly defined the development goals and specific measures for the next two years.

Clear: It proposes an average annual growth of around 5% in industry added value and an average annual growth of around 1.5% in the production of ten nonferrous, emphasizing the enhancement of domestic resource security and the supply capacity of high-end products such as copper, aluminum, and lithium.

Practical measures: The plan focuses on "uring resources, optimizing supply, promoting transformation, expanding consumption, and strengthening cooperation." For example, through green channels to accelerate the approval of mineral projects, promoting green and digital, expanding consumption in emerging fields such as new energy vehicles and AI servers, which directly benefit the long-term healthy development of the industry.

2. Robust downstream demand, core metal consumption

The rapid development of several high-activity terminal fields has formed a strong demand support for nonferrous metals.

New energy and electric vehicles: The popular of new energy vehicles has directly stimulated the demand for copper (with a copper consumption of more than 80kg per vehicle), lithium, and cobalt. At the time, the growth of photovoltaic installed capacity has also driven the consumption of antimony and other metals.

High-tech industries: The development of new productive represented by artificial intelligence (AI) has put forward higher requirements for computing power infrastructure. AI servers are big consumers of copper, and their large-scale construction has become a key variable drive up copper demand.

Recovery of traditional infrastructure: Metal-intensive industries such as railways, ships, and automobiles in China achieved double-digit growth at beginning of 2025, indicating that traditional industrial demand is also recovering.

3. Macro and financial environment is conducive

Changes in the external financial environment a decisive impact on the prices of nonferrous metals priced in US dollars.

The Federal Reserve begins the cycle of interest rate cuts: The market generally expects and ultimately confirms the Federal Reserve will restart interest rate cuts in 2025. The rate cut reduces the opportunity cost of holding interest-free assets (such as gold) and may weaken credibility of the US dollar, both of which together have pushed the prices of precious metals such as gold to new highs and boosted the risk preference of the entire nonferrous metal sector

Risk-averse sentiment heats up: Geopolitical conflicts (such as the Russo-Ukrainian situation) and uncertainties in Sino-US trade relations have the market's risk-averse demand, with capital flowing into safe-haven assets such as gold, further pushing up prices.

4. The industry's financial performance burst out in an all-round way

The most intuitive evidence comes from the financial report data of listed companies, showing that the industry as a whole has entered a performance upward cycle The following table summarizes the key financial indicators of the A-share nonferrous metal industry in the first three quarters of 2025:

(Additional Explanation) The data shows that the industry not only has been steadily expanding in terms of revenue, but has also achieved accelerated growth in terms of profits, reflecting a significant improvement in profitability. At the same time, the continuous improvement in cash flow indicates that the enterprises' "blood production" function has strengthened, providing a solid foundation for future investment and expansion.

In summary, the growth of the non-ferrous metals industry in 2025 was driven by a systematic trend jointly fueled by three engines: policy impetus, demand recovery, and monetary easing. The national-level "Stabilization Growth Work Plan" stabilized market expectations; emerging industries such as new energy and AI created new growth; and the Fed's interest rate cuts provided an excellent financial environment. These factors working together led to the industry's listed companies delivering outstanding performance in terms of revenue, profit, and cash flow, establishing a definite upward trend for the industry.

- 上一篇:霸刀分享-近期有色金属价格涨势汹汹

- 下一篇:霸刀分享-有色金属的应用领域